Buyer agents may have increased their commission rates as a hedge against the newfound ability of buyers and sellers to negotiate rates downward, following the landmark settlement last year by the National Association of Realtors.

That’s a key takeaway from a new report by the Consumer Policy Center, a consumer advocacy group whose researchers have long proposed regulatory changes that they believe would make the real estate industry more competitive and transparent for buyers and sellers.

The researchers found that commission rates have largely remained unchanged following the March 2024 commission lawsuit settlement agreement and ensuing business practice changes. They also highlighted missing enforcement mechanisms and ways the industry could welcome more competition.

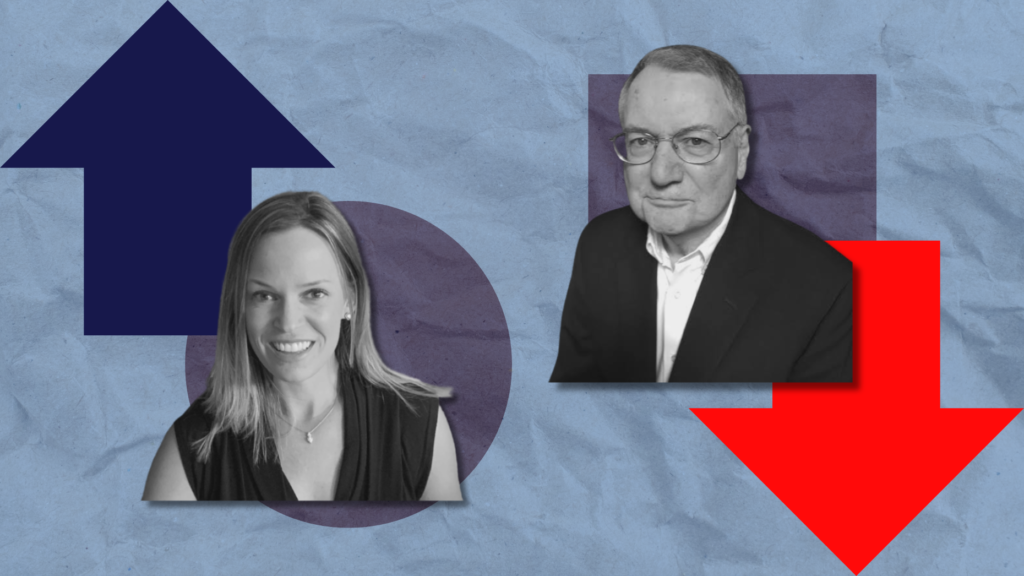

“Our research reveals an important reason that commission rates have not declined since the settlement of class action litigation forced changes in Realtor practices over a year ago,” said Stephen Brobeck, a CPC senior fellow. “The settlement provided homebuyers with new opportunities to negotiate commissions, but the industry has figured out how to minimize these opportunities.”

Brobeck is a consumer advocate whose research around real estate commissions has long suggested that buyers and sellers would benefit from changes to the status quo. The report was co-authored by Wendy Gilch.

The research included mystery shopper interviews with 281 buyer agents from 26 metropolitan areas between July and September of this year.

“We believe the interviews provide a good snapshot of how major national and regional firms are now communicating with individual buyers through its agents,” the researchers noted.

‘Standard’ commission rate

The report found that 95 percent of the agents in the study quoted a commission rate that was between 2.5 percent and 3 percent of the sales price, with the vast majority quoting a 3 percent rate.

“Several agents said they were charging the ‘standard’ or ‘usual’ rate in their area, evidence of price-fixing,” Brobeck and Gilch noted.

The study found that more agents are attempting to charge a 3 percent commission rate compared to a similar study conducted in 2022.

That may serve as evidence that agents are baking in a kind of “risk premium,” knowing that sellers are more empowered to offer a lower commission.

The researchers also found evidence that buyers and sellers are attempting to negotiate commission rates more after the settlement, but that the rates so far have remained rigid.

“A consensus has emerged that in the past two years, average rates have changed little. Initially, rates declined somewhat, but more recently, have returned to the average level before the 2023 jury decision.”

The report didn’t discuss the possible effects of the slow housing market on rates, and whether sellers are willing to offer a higher buyer agent commission in an attempt to ensure their homes sell.

No enforcement

The researchers questioned whether there was any enforcement mechanism to ensure that buyer agents are truly obtaining signed representation agreements before showing properties to prospective buyers.

It found that 17 percent of agents surveyed said signed contracts were only required before making an offer on a property, and a few more said contracts weren’t required.

The settlement agreement didn’t include an enforcement mechanism, and Inman’s first-hand tests of the buyer experience have shown that some agents do facilitate showings before obtaining signed agreements.

However, the study found that more than half of the agents surveyed required signed contracts upfront before any showing, including virtual showings.

The takeaway

The report noted that two barriers to price competition were removed as part of the settlement: the removal of mandatory offers of buyer broker compensation from the MLS and the requirement to obtain signed representation agreements before showing properties.

“The removal of these barriers, while necessary, was not sufficient to ensure more successful consumer negotiation of commissions,” the researchers wrote.

“While future buyer and seller attempts to negotiate buyer [compensation] might increase as they learn more about the new negotiation opportunities, it has become increasingly apparent that successful agent workarounds have greatly limited these opportunities,” they wrote. “Buyers are still assured by most agents that sellers will pay their commissions. And if sellers fail to do so, they fear that their homes won’t be shown.”

The report suggested that regulations should be updated to allow buyers to finance their agents’ commissions through their mortgage loans, citing a widespread belief that this price is already implicitly included within a sales price.

If buyers could finance their agent’s commission, the researchers said, home prices would fall. This would also create a better opportunity for buyers and sellers to negotiate commissions.

Advice to buyers and sellers

The researchers included advice to consumers.

For buyers, they recommended asking prospective agents about their compensation and willingness to negotiate it. They said buyers should ask whether the agent would accept a lower commission if sellers offered less than what was agreed upon.

They also said buyers should push for shorter agreements to start, and that they should aim to sign agreements that are no longer than three months.

For sellers, the researchers said that “many buyer agents will lower their compensation if there is pushback.”

“In interviewing prospective listing agents, sellers would benefit from asking whether the agents are prepared to communicate to buyer agents a willingness to negotiate their compensation, not ever disclosing a specific amount,” they wrote.

Email Taylor Anderson