Power.

Technology such as AI helps lenders provide better guidance and advice for borrowers. This boosts customer satisfaction, and leads to repeat business. J.D. Power.

Mortgage lenders who equip “high-touch” loan advisors with technology like AI that helps them deliver useful advice to borrowers are earning the highest customer satisfaction scores, setting them up to win repeat business, according to an annual survey by J.D. Power.

J.D. Power’s 2025 U.S. Mortgage Origination Satisfaction Study, which surveyed more than 10,000 borrowers who bought a home or refinanced in the past 12 months, showed overall customer satisfaction with lenders was up 5 percent from a year ago, to 760 on a 1,000-point scale.

Lenders are doing a better job providing useful guidance or advice, and those who are able to connect with customers before they’re actively shopping for a home score 32 points higher, J.D. Power stated.

These are hallmarks of AI-based tools which can determine when customers are ready to purchase or refinance a home and evaluate their financial situation to provide loan options. The survey found borrowers who get useful guidance were 2.3 times more likely to say they “definitely will” choose the same lender for future loans.

Bruce Gehrke

“Mortgage lenders have come to recognize that the more educated their customers are about the details of their mortgage products, the more loyal and lucrative their relationships become,” said J.D. Bruce Gehrke, a Power executive said in a press release. “The highest-ranked lenders in today’s market aren’t just those with the best rates; they’re the ones that have perfected hybrid engagement.”

Some of the nation’s biggest lenders, including United Wholesale Mortgage (UWM) and Rocket Mortgage, have touted AI as crucial in helping them grow their business by delivering better service to borrowers with fewer employees.

Most borrowers surveyed by J.D. Power said that they were “completely” or “partially” comfortable with the use of AI by their lender in the mortgage-origination process. But nearly three in four (71 percent) said it was “very important” for their lender to inform them when they are using such technology.

Nonbank lenders like UWM and Rocket have taken the lion’s share of the mortgage business away from traditional banks, with companies like Wells Fargo intentionally dialing back its market share.

But banks, which have made their own major investments in AI, dominated J.D. Power’s mortgage originations customer satisfaction ranking, taking six of the top 10 spots.

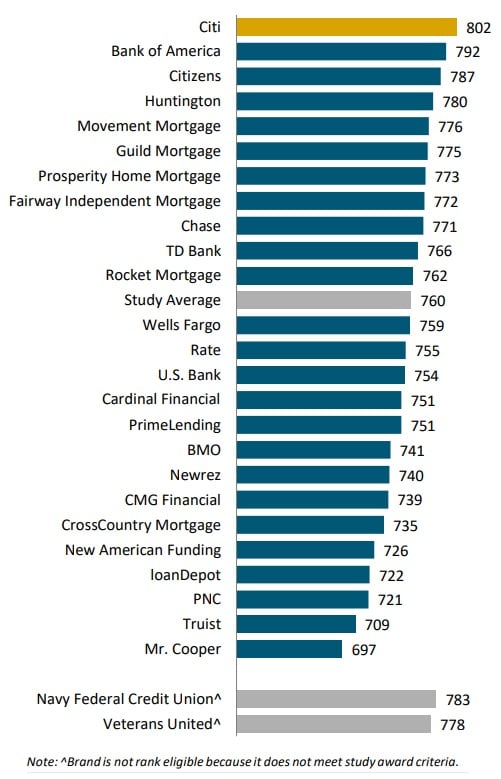

Mortgage origination satisfaction ranking

Source: J.D. The top four banks in J.D. Power’s 2025 U.S. Mortgage Origination Satisfaction Study are Citi (802), Bank of America (792), Citizens (787) and Huntington National Bank (780).

Other banks scoring above the industry average were Chase (771) and TD bank (766), with nonbank lending giant Rocket Mortgage scoring slightly better (662) than the industry average of 760.

As a wholesale lender that originates loans through independent mortgage brokers, UWM Power rankings — Citi (802), Bank of America (792), Citizens (787) and Huntington National Bank (780) — are all traditional banks.

The top four were trailed in the rankings by Movement Mortgage (776), Guild Mortgage (775), Prosperity Home Mortgage (773) and Fairway Independent Mortgage Corp. (772).

Other banks scoring above the industry average of 760 were Chase (771) and TD Bank (766), with nonbank lending giant Rocket Mortgage scoring slightly better (762) than the industry average of 760.

As a wholesale lender that originates loans through independent mortgage brokers, UWM was not ranked.

Companies scoring below the industry average included loan servicing giant Mr. Cooper (697), Truist (709), PNC (721), loanDepot (722), New American Funding (726) and CrossCountry Mortgage (735).

Rocket Companies acquired Mr. Cooper last month in a deal valued at $14.2 billion, with Mr. Cooper Chair and CEO Jay Bray becoming president and CEO of Rocket Mortgage.

Both companies have invested heavily in AI, but Mr. Cooper has ranked below the industry average for mortgage servicers in a separate J.D. The Power Survey has been conducted for over a decade. Rocket Mortgage was ranked number one in the J.D. Power’s 2025 U.S. Mortgage Servicer Satisfaction Study. Power’s 2025 U.S. Mortgage Servicer Satisfaction Study.

Rocket, which closed a $1.8 billion deal to acquire national real estate brokerage Redfin on July 1, has set a long-term goal of capturing 8 percent of the purchase loan market and 20 percent of the refinancing business, up from 3.9 percent and 11.3 percent in 2024.

Rocket CEO Varun Krishna sees AI as crucial to growing Rocket, Redfin and Mr. Cooper under the same roof.

“The reason that we are so obsessed with this technology is because it helps us with every single aspect of our business,” Krishna said on the company’s third-quarter earnings call. It is important to Varun Krishna, Rocket CEO and Redfin’s Chief Executive Officer that AI be used in order to grow all three companies under the same roof. We can increase conversions. “It helps reduce costs and increases capture. Every Wednesday, we deliver a weekly summary of the most important news from the mortgage and closing industry. Click here to subscribe.

Email Matt Carter