Quick Read

- D.R. Horton acquired a stake in AI mortgage startup Tidalwave as part of a $22 million Series A funding round and plans to implement Tidalwave’s AI mortgage POS platform at its DHI Mortgage subsidiary.

- DHI Mortgage, the largest homebuilder lender with over 70,000 loans in 2024 totaling $24 billion, is expected to leverage Tidalwave’s technology to improve mortgage processing efficiency and reduce errors.

- Tidalwave’s AI platform integrates with Fannie Mae and Freddie Mac systems and ICE Mortgage Technology, enabling the handling of 200,000+ loans annually; it recently expanded its client base and executive team.

- Homebuilders’ mortgage subsidiaries like DHI Mortgage are capitalizing on technology advancements amid a forecasted 5 percent increase in new home sales in 2026, aiming to enhance customer financing options and operational innovation.

An AI tool created this summary, which was based on the text of the article and checked by an editor.

In addition to participating in a $22 million Series A raise, D.R. Horton will be a Tidalwave customer, deploying its AI-powered platform across mortgage subsidiary DHI Mortgage in a “landmark mortgage tech deal.”

The nation’s biggest homebuilder, D.R. Horton, is taking an ownership stake in agentic AI mortgage technology startup Tidalwave as a participant in a $22 million Series A raise.

D.R. Horton will also be a Tidalwave customer, deploying its AI-powered mortgage point-of-sale (POS) platform across its mortgage subsidiary, DHI Mortgage, in what the companies characterized as a “landmark mortgage tech deal” in an announcement Friday.

Most homebuilders offer financing through subsidiaries or affiliated businesses, and DHI Mortgage is the largest, funding more than 70,000 mortgages totaling $24 billion in 2024.

Tidalwave says the funding round, led by Permanent Capital with a follow-on from Engineering Capital, brings total funding raised to date to $24 million and will enable the company to process more than 200,000 loans a year for clients.

TAKE THE INMAN INTEL SURVEY FOR NOVEMBER

Diane Yu

“The mortgage industry has long been reliant on disjointed tools and manual intervention, leading to costly delays and errors,” Tidalwave co-founder and CEO Diane Yu said in a statement. “With this new funding, we’re supercharging the buildout of intelligent AI agents, allowing us to get these tools into the hands of lenders and borrowers faster than ever.”

A 2025 Inman AI Award winner, New York-based Tidalwave rolled out integrations with Fannie Mae’s Desktop Underwriter and Freddie Mac’s Loan Product Advisor last year, then made its AI technology available to most lenders in March through integration with ICE Mortgage Technology’s Encompass digital lending platform.

This year Tidalwave has hired former ICE executives Chris McLendon and John Stephenson as chief revenue officer and head of sales, respectively, and expanded its client base to include NEXA Lending, First Colony Mortgage, and Mortgage Solutions of Colorado LLC.

The nation’s biggest mortgage lenders, United Wholesale Mortgage (UWM) and Rocket Mortgage, are making major investments in AI and other technology to help them deliver better services more efficiently — and potentially scale their businesses without having to staff up if mortgage rates fall.

Executives at small- and mid-size lenders say they don’t want to be left behind, and Tidalwave is one of a number of companies offering tech tools to help them compete, including Xactus and Gateless. Amazon Web Services, Google Cloud and Microsoft Azure have developed proprietary AI and machine learning capabilities that can be customized for lenders.

Until now, NEXA Lending was Tidalwave’s biggest client. A correspondent lender, NEXA Lending sponsors 3,418 mortgage loan originators working out of 248 branch offices serving 48 states and Washington, D.C. — everywhere but Massachusetts and New York, according to records maintained by the Nationwide Mortgage Licensing System.

Homebuilders’ mortgage arms, which typically offer rate buydowns as incentives to homebuyers, are a promising area of growth, with Fannie Mae forecasting sales of new homes will grow by 5 percent next year, to 704,000.

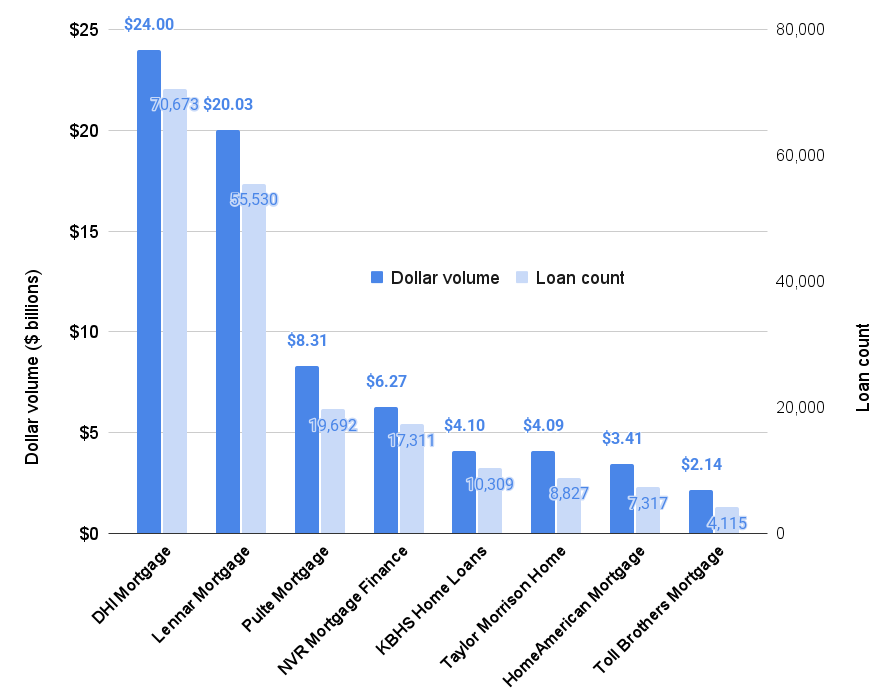

Homebuilders 2024 mortgage originations

2024 mortgage originations by homebuilders’ lending arms. Source: iEmergent.

D.R. Horton’s mortgage arm, DHI Mortgage, led the pack in 2024 with $24 billion in originations, followed by Lennar Mortgage ($20 billion), Pulte Mortgage ($8.3 billion) and NVR Mortgage Finance ($6.27 billion), which serves customers of Ryan Homes, NVHomes and Heartland Homes.

KBHS Home Loans ($4.1 billion), Taylor Morrison Home Funding ($4.09 billion), HomeAmerican Mortgage ($3.4 billion) and Toll Brothers Mortgage ($2.1 billion) provided loans to more than 30,000 homebuyers last year, according to lender data tracked by iEmergent.

DHI Mortgage CEO Mark Winter said in a statement that the partnership with Tidalwave “represents an alignment of vision, innovation, and execution. Both of our companies share the goal of advancing the mortgage process through AI by empowering our people and providing powerful new tools to enhance quality and efficiency.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter